Total value sales data from Britain’s Builders’ Merchants shows Q4 2021 recorded the third-highest quarterly BMBI sales ever, rounding off a record-breaking year for merchants.

However, with growth driven exclusively by pricing – not volume – the figures suggest the 2021 trade boom has inevitably slowed.

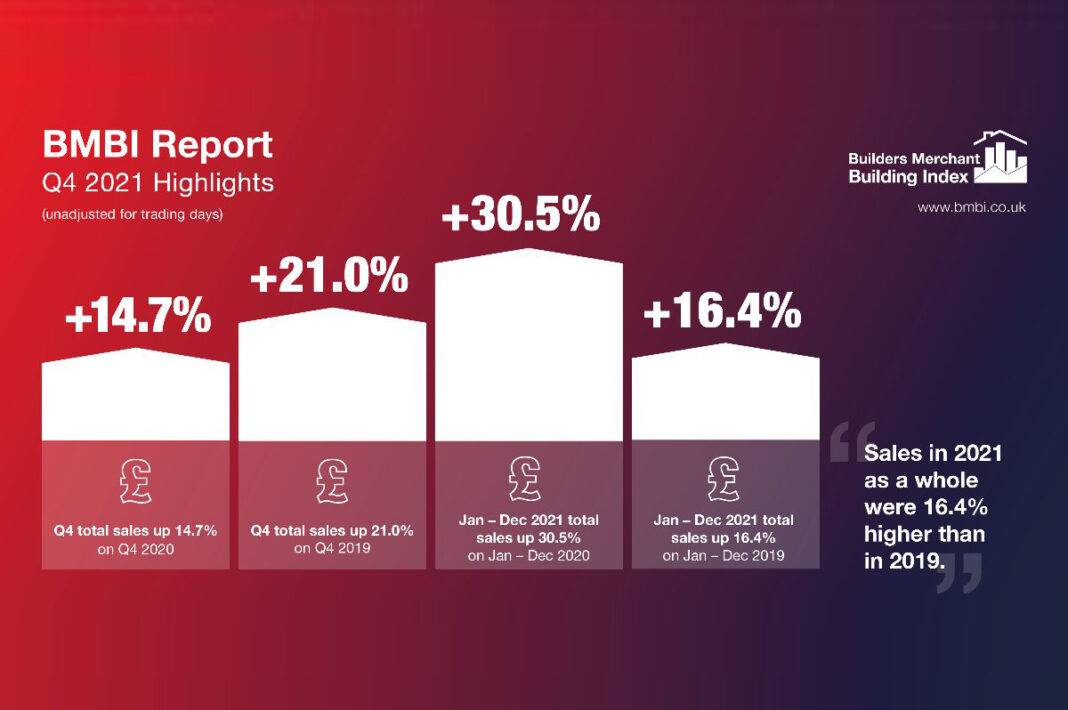

Quarter 4 2021 total value sales were 14.7% higher than Q4 2020, with no difference in trading days. All categories sold more. Timber & Joinery Products was out in front (+28.2%), follow by Landscaping (+14.4%). Heavy Building Materials (+11.1%), Kitchens & Bathrooms (+10.0%), and Plumbing Heating & Electrical (+9.6%) grew more slowly.

Comparing Q4 2021 with Q4 2019, a more normal pre-Covid year, total value sales were 21.0% higher with the benefit of one more trading day. Nine of the twelve categories sold more, including Timber & Joinery Products (+44.4%) and Landscaping (+40.6%).

Turning to project starts, a significant takeaway from Glenigan’s February edition of its Construction Review, is that, while underlying project starts (those with a construction value of less than £100 million) have been abnormally weak in January, a rise in detailed planning approvals, and main contract awards, offer hope for the coming months.

Despite project starts continuing to weaken during the three months to January, with a decline in both underlying projects (under £100 million) and major projects (£100 million+), a firm development pipeline is in place. This will be helped along by the easing of supply shortages which is due to provide a welcome boost to project starts in future months.

The sharpest decline was seen in major projects (£100 million+), averaging £966 million a month, half the value of the preceding three months and 16% lower than a year ago. Detailed planning consents are also helping to combat a 26% drop in the value of project-starts from over the past three months, showing promise that work is on the horizon.

Glenigan reports that the uptick was driven by a 23% increase in underlying project approvals (less than £100 million in value) against Q4 2021, to stand 15% up on a year ago.